6 Steps to Successfully Sell Your Vacation Rental Business

Selling a short-term vacation rental business is no small decision. It’s a process that combines the complexity of a multi-month due diligence process with the nuance of numerous moving pieces. However, the acquisition process can be more streamlined when armed with the right knowledge. Whether you’re considering retirement, shifting your career focus, or would just like to cash in on your investment, here are 6 steps on how to sell a vacation rental management business successfully.

1) Consult with Advisors

M&A Consultant

An experienced M&A consultant can add enormous value to your business sale. They will analyze the approximate value of your business, identify potential obstacles, discuss the challenges and opportunities you’ll face as a seller, find well capitalized buyers, and negotiate all business terms in your best interest. Additionally, with years of transactional experience, industry M&A advisors will give insights into industry trends & factors that could affect the sale.

>>As the leading vacation rental M&A firm in the industry, C2G Advisors is fully prepared to support you in selling your business whenever the time is right.

Attorney

An attorney can make or break a deal. Be wary of hiring an attorney that does not have transactional experience. Many times, your M&A Consultant can recommend one.

CPA

Talk with your CPA on how you will be taxed based on the structure (asset vs stock), timing, terms, and the purchase price allocation.

Wealth Advisor

Whether you are retiring or shifting careers, talk with an expert on what to do with the money after an M&A Consultant evaluates your business.

All in all, a good short term rental advisory firm will tell you if & when your vacation rental business is ready to sell based on your goals. They will give you the good, the bad, and the ugly, and hold your hand throughout every stage of the multi-month process.

» To learn more about the ins and outs of selling your business check out our article on the Mergers & Acquisitions process

2) Get Your Financials in Order

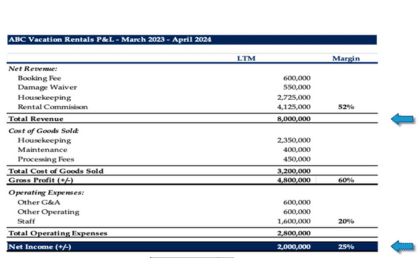

Buyers will want to see your prior 3 years income statements and balance sheets. You should track and measure these on a monthly basis. It is also helpful to create a list explaining the various revenue and cost of goods sold (COGS) line items, so Buyers can understand how your vacation rental business financially operates. If you have any one-time outliers or unique expenses, talk with your accountant/bookkeeper to further grasp what they are. Understanding the financial hygiene of your short term rental company prior to the sales process is paramount.

» Pro tip: The sooner you start on 1 and 2, the better outcome you will have when selling your business

3) Set Realistic Goals for the Sale of Your STR Business

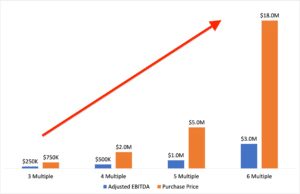

This chart depicts the last twelve-months adjusted EBITDA and the final purchase price of a seller’s vacation rental business

We’ll be the first to say it: Selling a vacation property management business is NOT an easy process. Therefore, don’t waste your time and energy if you haven’t reached your goals. Your goals should reflect the actual value of your VRM business. If you want to exit with a $5M purchase price, then your company should hold that value in the current market. Maybe you’re currently at $500K in last 12-months earnings. At a 4x multiple of earnings, that’s a “back of napkin” value of $2M; much less than your $5M goal. There are things that you can do to increase the value of your business, but it’s imperative to have realistic goals prior to going to market.

4) Review Your Short Term Rental Contracts

Homeowner contracts are key assets of your vacation rental business; therefore, make sure they’re transferable or assignable. Prior to selling your business, you’ll need to review all of your contracts to make sure the language is adequate, not just a template contract.

Asset Purchase

Approximately half of the business transactions we see are asset purchases, meaning that a buyer is buying the assets of your company… not the actual legal entity. An asset deal will require that all your management contracts are assignable without the consent of the homeowner. There are other key clauses to review, but this is critical to allow you to transfer your contracts to a buyer. Without this language in place, buyers may require the contracts to convert at closing. This creates more friction in the process and could decrease the total proceeds of the sale.

Membership Interest Purchase

In a membership interest purchase (or stock deal), the buyer will acquire your legal entity and all the assets it encompasses. Assignment language is typically not required for this type of sale; however, there are some “change of control” provisions that may apply.

Another point of concern is “homeowner concentration”. It is a risk if one homeowner owns a large percentage of your inventory. This will give buyers hesitation and there will be contingencies placed on the Purchase Price

» Read more about desired language in management contracts

5) Research Potential Buyers

Vacation rental company buyers typically require seller assistance throughout a transition period. You’ll be trusting them with your company’s brand, employees, homeowners, and some portion of the deferred purchase price. Therefore, it’s important to understand the different industry buyers to find the right partner for your business moving forward.

Current buyers range from regional strategics, national venture capital-backed, and large & small private equity. Each buyer has specific parameters for their target acquisitions, and they have a go-forward plan regarding company brand, staff, potential rollover equity, and business owner involvement post-close. Depending on what’s important to you, there are many different components to consider when heading towards an exit.

» Review more about the types of buyers in this article

6) Execute, Execute, Execute

Build your business to fit your goals, hire an M&A advisor, prepare your company to sell, market the business, review offers, negotiate, work tirelessly during due diligence, negotiate more, sign the closing documents, and finally… receive your money. Congratulations, you sold your business!

The acquisition process can be arduous, especially while you’re concurrently managing your business. After the deal closes, there is a typical transition period for the Seller to assist the Buyer. While the deal may have closed, most transactions have some amount of “holdback” payments that are contingent on post-closing targets. In the interest of both parties, it’s vital to work together in making the experience seamless for homeowners, employees, and vendors.

While selling your vacation rental management business can be a joyous experience, it’s not an easy task. That’s why it’s important to have an experienced team on your side who can navigate the complexities of how to sell a vacation rental management business. Contact C2G Advisors today to see how we can maximize the value of your business.

Contact Us Today!