Business Valuations 101: How Vacation Rental Companies Are Valued

One of the most frequent questions we get is, “What’s my vacation rental company worth?” The answer isn’t always straight forward. However, business valuation methods used in the industry are. Let’s break down the two main valuation methods we use to figure out the value of a vacation rental business: the Adjusted EBITDA method and the Price Per Contract method.

The Multiple of Adjusted EBITDA Method

What is EBITDA?

EBITDA might sound like complex financial jargon, but it’s actually pretty straightforward. EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization. Essentially, it’s your net income with irregular or non recurring costs added back to it. These adjustments make the EBITDA a reliable metric for understanding the core profitability of your business without the noise of one-time transactions or unusual expenses.

*This method determines your business value based on your company’s Last Twelve Months (LTM ) Adjusted EBITDA.

How to Arrive at Your Adjusted EBITDA

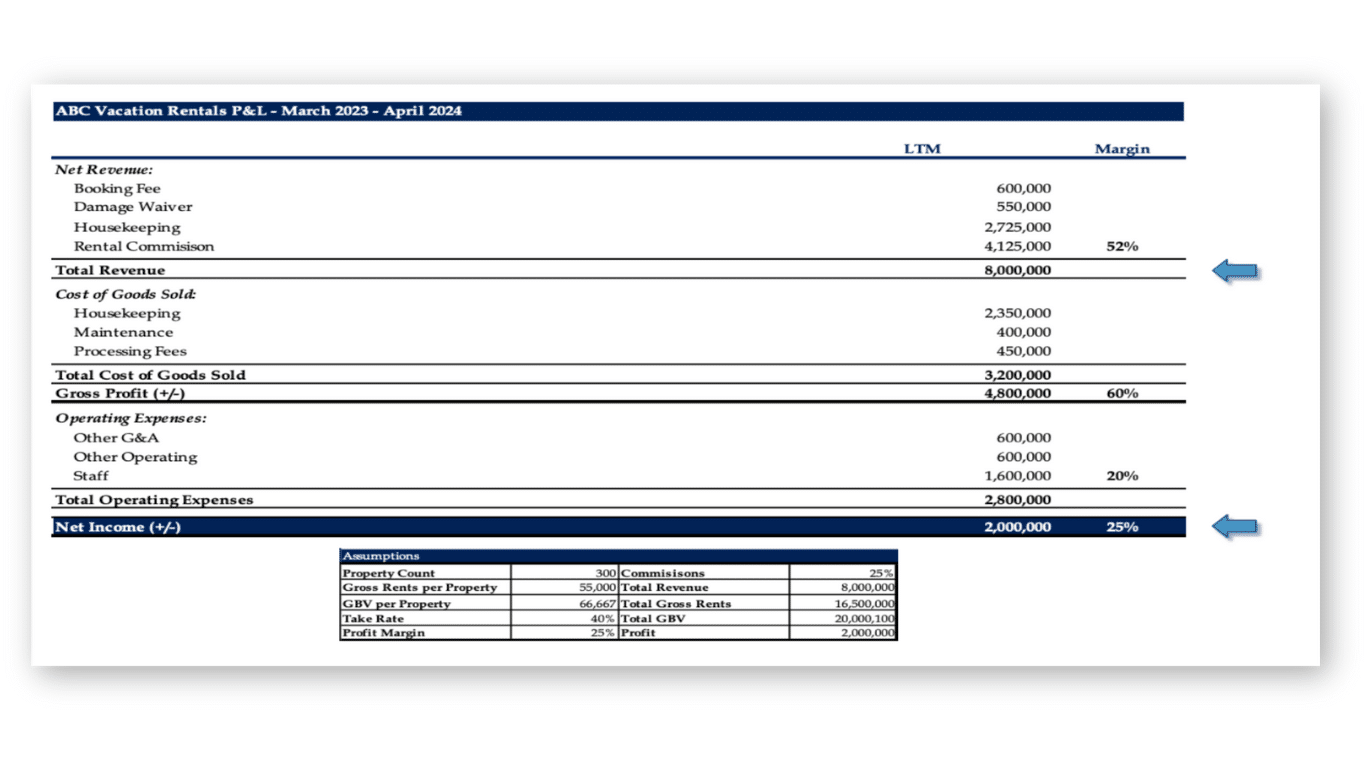

To understand this valuation method, it helps to understand how you get your Adjusted EBITDA. Let’s take a look at an example. Below is a P&L (Profit and Loss) statement for an imaginary vacation rental company, ABC Vacation Rentals.

The P&L above lists all the streams of revenue for this company (booking fees, cleaning fees, etc.) to come up with the Total Revenue. Below total revenue, the P&L lists the Costs of Goods Sold otherwise known as COGS. COGS are the expenses directly tied to each revenue stream. For instance, the cost of hiring a cleaning crew is a direct expense related to the cleaning fees charged by your company. By subtracting the direct costs from your earnings, we get the Gross Profit.

Below Gross Profit on the P&L, you’ll find a section listing all other costs, which includes expenses not directly tied to revenue streams, such as salaries and office supplies. By subtracting these operating costs from Gross Profit, we arrive at Net Income—the total earnings of the company.

>>To dive deeper into key performance metrics, such as COGs, check out our article on increasing the value of your vacation business.

EBITDA Add-backs & Deductions

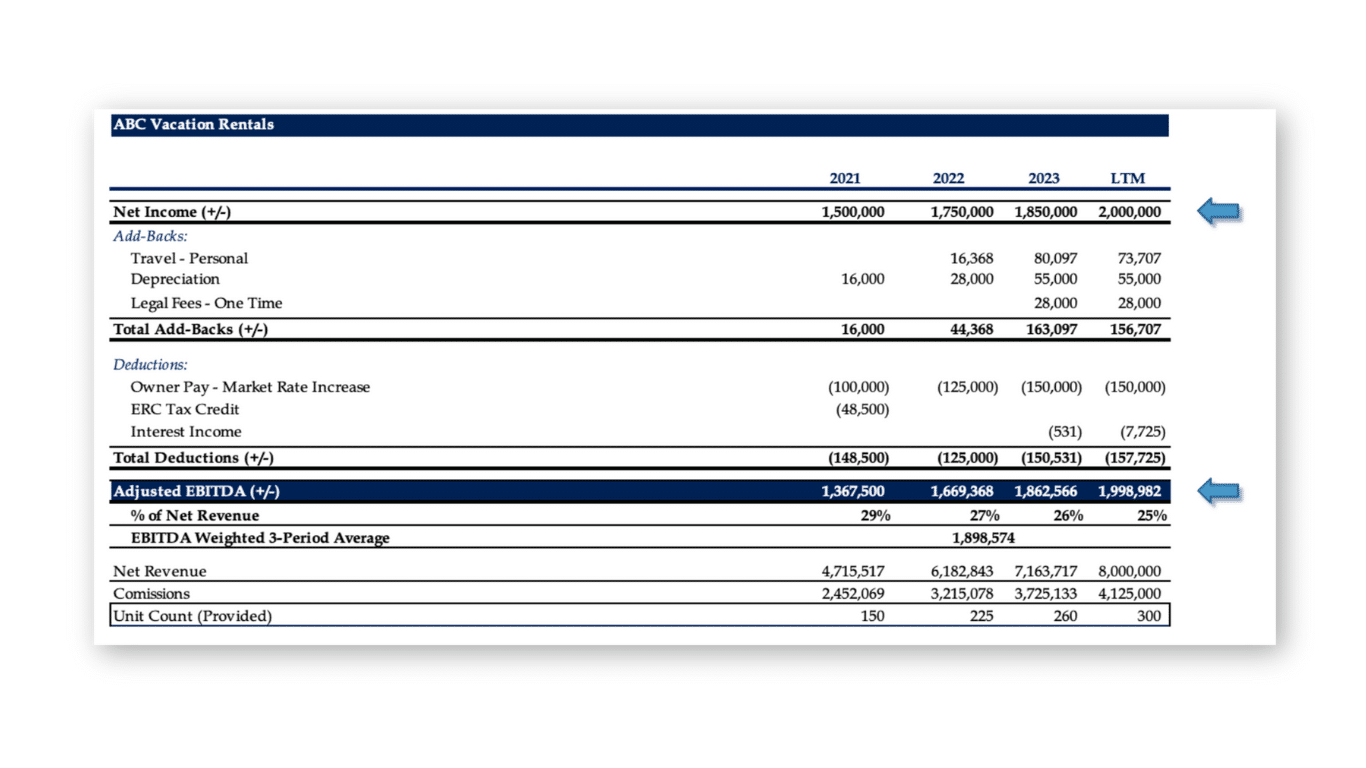

Let’s look at the next figure where we adjust these earnings by removing unusual expenses called ‘add-backs’. Additionally, you’ll notice there are a few typical business expenses that were overlooked in P&L like Owner salary, personal travel and interest income.

Add-backs are essentially one-time or non-recurring business expenses that are ‘added back’ to the Net Income because they do not reflect regular expenses. Similarly, it’s crucial to account for typical business expenses that may not have been initially included in the P&L, such as a market-rate salary for the owner. These expenses, once identified, are deducted to ensure the financials accurately reflect all operational costs a prospective buyer would assume.

By normalizing the P&L, we arrive at the Adjusted EBITDA. In this example, you’ll notice data spanning three years alongside the LTM (last twelve months). This detail is crucial in this valuation method. The multiple used to determine your company’s worth is based on your LTM Adjusted EBITDA.

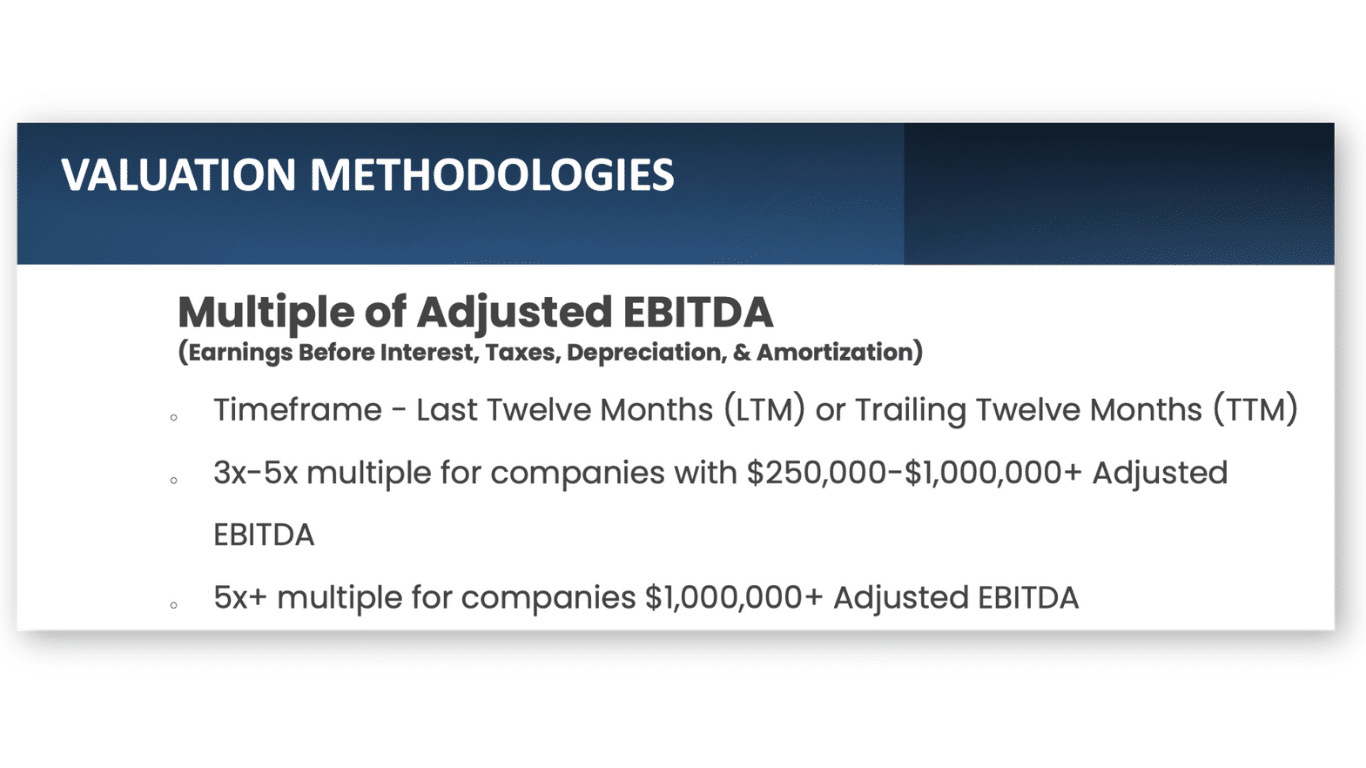

Valuation Multiples

Here comes the fun part. Based on your Adjusted EBITDA, your business can be valued by applying a multiple. For example, if your Adjusted EBITDA is $200,000, and businesses like yours are often worth three to five times that amount.

Here’s a quick break down of the valuation method and the standard multiples:

Price Per Contract Method

The Price Per Contract method is the second valuation method used in our industry. This method is less structured than the multiple of Adjusted EBITDA approach. Typically, this method is reserved for smaller or less profitable companies. If you’re Adjusted EBITDA is less than $250,000.00, then you are likely looking at this valuation method.

What Are the Multiples for This Method?

With this method you are typically looking at a 1 – 2x multiple on your companies annual commissions. For the sake of a simple explanation, let’s say your company makes $100,000 in annual commissions. With the 1 – 2x multiple, your business could sell for somewhere between $100k and $200k.

In conclusion, understanding business valuation can be tricky, but you don’t have to do it alone. At C2G Advisors, we’re here to help you figure out what your vacation rental business is truly worth. Whether it’s using the LTM Adjusted EBITDA or the Price Per Unit method, these are the standards for assessing value.

Got questions? Feel free to reach out. We’re here to help you navigate these financial waters!

Contact Us