How Much is My Vacation Rental Business Worth in 2024?

If the idea of selling your short-term rental business has crossed your mind, you’ve likely pondered the age-old question: How much is my company actually worth? You might think this is territory reserved for financial gurus and M&A experts. But guess what? By measuring a bit of your company’s data, estimating a value for your STR business is more simple than it sounds. Here are the top business valuation methods for property management & vacation rental companies in 2o24.

In this article we’ll discuss:

- The Multiple of Adjusted EBITDA Valuation Method

- What Factors Make for a Higher Multiple

- The Price Per Unit Method

- Checking Your Work

- Deal Structures

- Buyer Demographics

Now, let’s dive in and look at a couple of methodologies to value your property management business. These formulas will help give you a high-level understanding of what your company may be worth on the market.

Multiple of Adjusted EBITDA Valuation Method

The primary approach is the Multiple of adjusted EBITDA valuation method. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is calculated over the Last Twelve Months (LTM e.g. Oct 2022 – Sep 2023). Typically, property management companies are valued at a multiple of 3x to 5x of their adjusted EBITDA.

What factors make for a higher multiple?

Several key factors come into play that determine your business’s valuation multiple. This can include the markets, financial hygiene, advanced pacing, annual growth, staff, brand and much more. Let’s dive deeper into a few metrics that can move the needle on your multiple.

Financial Health

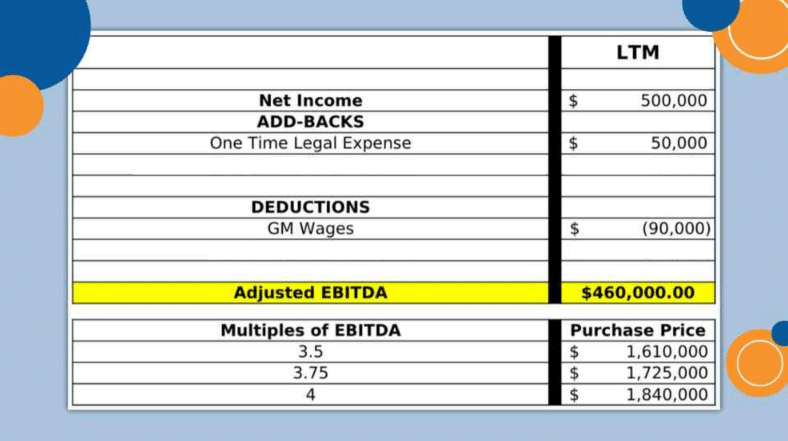

First and foremost, let’s talk about keeping clean financials. In the early years of the pandemic when buyers were flush with cash, you might have been able to get away with messy financials. Since then, the vacation rental industry in the United States has settled down. Buyers expect a higher level of professionalism when it comes to proper bookkeeping. It’s important to know what revenue, COGS, and expense accounts should be included in your financial statements. Take a look at this adjusted EBITDA example…

When adjusting your EBITDA, start at your Net Income over the LTM time period. Then, consider ‘adding back’ items you initially expensed. Examples could be one-time legal expenses, or certain taxes you may have expensed like occupancy taxes. Remember, the ‘T’ in EBITDA stands for taxes (not all taxes are removed from EBITDA i.e., payroll tax). Then, consider missed deductions like GM wages, , if you don’t pay yourself a salary, and if you record occupancy tax as revenue. Once you’ve added and subtracted the appropriate income and expenses, you’ll arrive at your adjusted EBITDA number. With that figure, you’re all set to estimate how much your company might be worth. In this example, the adjusted EBITDA came out to be $460,000.00. Following the general rule this company would typically be valued between 3x to 5x their adjusted EBITDA. Typically businesses less than $500K of EBITDA fall in the 3x-4x multiple

range

>>If you’re seeking assistance with assessing the valuation of your short-term rental business, check out our general and strategic consulting services here!

Unit Growth

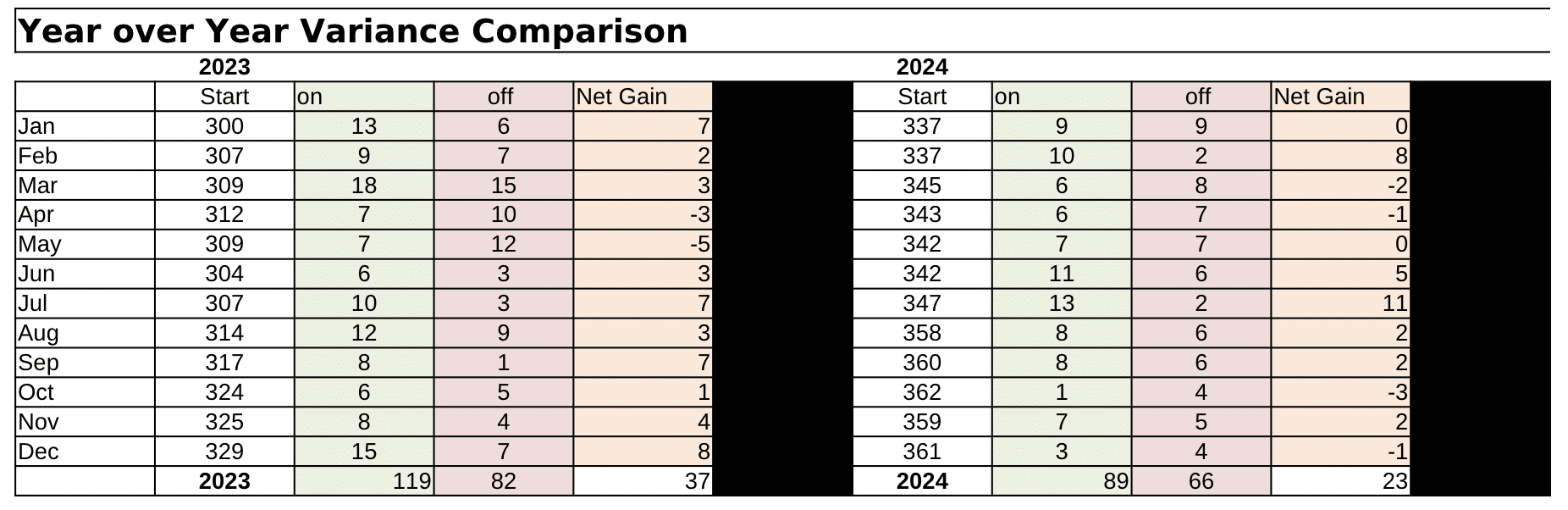

Consistent growth of rental units demonstrate a company’s stability and future health, making it more appealing to potential buyers. Not only unit growth, but also unit churn It’s important to keep a monthly log of units gained and lost, with reasons. Take a look at the units gained and lost example spreadsheet below

> If you’re not keeping a monthly log of units gained and lost, then start today!

Staff

The strength of the company’s staff is another critical factor. A capable and experienced team adds value to the company. If you’re planning to sell your vacation rental business in the future, it’s crucial to start delegating certain key tasks, such as homeowner relations and daily management of operations. Buyers can be hesitant to acquire businesses where the owner is heavily involved in the day to day. If this sounds like you, start considering how you can strategically take a step back.

Homeowner Contracts

Homeowner contracts can significantly impact valuation. Stable homeowner contracts with longevity provide a seasoned revenue stream. We’ll dive more into this in a minute with the discussion of Price Per Unit.

With exceptional performance, strong growth prospects, and solid fundamentals can indeed demand higher multiples.

>> Read more about how you can increase the value of your short-term rental business

Price Per Unit

When digging into how much your vacation rental business is worth, the price per unit method is another option. This is typically for businesses with fewer than 50 units, limited history, or companies with limited financials. There is no one-size-fits-all standard to determine the price per property and can vary depending on several factors. Here at C2G Advisors, we’ve seen anywhere from $5k to $60k a unit. Our average sales price per unit in 2022 was $32K.

How to Calculate Price per Unit

For starters, begin by examining your company’s Gross Rents per unit over the LTM (last twelve months). In today’s market, a per unit valuation can be in the range of 25% to 35% of the Gross Rents. For instance, if a 5BR house generates $100,000 in Gross rent, a potential buyer might value that unit at $25K – $35K. Similarly, if a 2BR condo generates $50,000 in Gross Rent, a buyer might value that unit at $12,500.

Keep in mind, numerous variables can influence the valuation significantly. Market and location can play a pivotal role as well. For example, a property located in on the beach in Florida may be valued higher than one in Detroit, Michigan (no offense to our neighbors up north). Generally, quality properties in a high demand market are positioned for better valuations.

Moreover, seasoned contracts with strong legal terms further contribute to higher valuation. Contracts with automatic renewals, homeowner termination restrictions, and that allow assignability are all compelling reasons that can enhance the attractiveness of your units.

Typically for smaller vacation management companies, buyers often will assess and assign individual unit prices.

>> To learn a bit more, read our VRM Intel article on ‘back-of-the-napkin analysis’

Check Your Work

Now here’s where middle school math comes in. You “believe” that you have found the solution, BUT now it’s time to check your work.

A simple way to see if you’re operating efficiently, is to compare yourself to industry standards. Industry standard EBITDA is around 10% of your Gross Rent (nightly rate, not including guest fees or taxes) **

For example, let’s say your business operates 100 units

- Gross Rent: $5M

- Adjusted LTM EBITDA: $500k (10% of Gross Rent)

- 3.75x-4.025x = $1.875M – $2.0M

Deal Structures

It’s important we emphasize words such as ‘typically’, ‘normally’, and ‘usually’. Why, you ask? Because everything is up for negotiation. A common phrase we say in the industry is ‘you name the price, I name the terms’. Below we review ‘typical’ deal structures.

Seller Notes & Contingencies

When selling a short-term rental business, it’s common to encounter what we call ‘Seller Notes.’ These Seller Notes are essentially promises from the buyer, like a loan. A down payment is made at closing, and the remaining payment is spread out over the next one or two years, sometimes contingent upon the company’s performance.

You might wonder why sellers don’t get all the money upfront. Well, it’s a standard practice in our industry. Buyers want to ensure that the business they’re purchasing will in the future

as it did in the last twelve months. Vacation rental managers are not hotels…their inventory fluctuates which makes them a higher risk business.

The secondary payments are often contingent using comparable metrics such as unit count, revenue, or EBITDA. Depending on your agreement with the buyer, you can use this to your advantage. For instance, if your expertise lies in business development, you might negotiate terms where the unit count is the target the contingency is based on.

Let’s consider a brief example: Company A sells to Buyer for $4 million. After negotiations, they agree that the Buyer will make a $2M cash down, followed by $2M after 12-months. The $2M is contingent on the Company maintaining at least 95% of the number of units they had at closing. This example gives you an idea about what kind of deal structures you may encounter.

Rollover Opportunities

During the negotiation process, you may come across an interesting option known as a “rollover.” This opportunity allows you to reinvest a portion of the proceeds from selling your vacation rental business into the new company. It’s a strategy often used with private equity firms. Buyers may agree to less contingencies in exchange for the seller rolling equity into their venture. This arrangement can strategically benefit both parties. For the buyer it provides a loyal seller with some “skin in the game” and the seller gets to invest into a larger entity and likely has less

contingencies on their purchase price.

What Types of Vacation Rental Buyers Are Out There?

Venture Capital Backed

In the world of short-term rental business M&A, there are various players with distinct strategies and objectives. One category consists of VC backed firms. These investors are often driven by revenue, pricing per contract, and EBITDA. What sets them apart is they usually have brand consistency across all their markets. They are often on track toward public markets, sometimes publicizing their acquisitions.

Private Equity Backed

On the other hand, private equity firms take a different approach. They tend to focus on acquiring companies with a strong brand, higher, EBITDA, and/or over 100 units of inventory. PE firms typically maintain the seller’s brand identity in each market. Furthermore, these investors often encourage sellers to invest in and stay involved with the new company. These types of buyers usually carry out their acquisitions discreetly, without public announcements.

Strategic Operators

Lastly, we have strategic operators. These are businesses operating in the same or complementary markets, seeking to expand for increased cash flow and diversification. Strategic operators will often absorb the seller’s brand into their larger local brand for a unified and cohesive market presence. This is called a “tuck in”. Sellers having a hard time finding a buyer may look to a larger competitor to buy them out.

There are a couple ways of calculating how much your vacation rental business is worth. If your company is an established business with around 100 or more units, then you may want to consider the multiple of adjusted EBITDA method. On the other hand, if you are a smaller mom and pop operation, the price per unit method will likely be a better fit.

You should now have all the tools needed to calculate a high-level valuation of your vacation rental business. Additionally, we’ve provided what typical deal structures look like and the buyers demographics in the M&A market!

At C2G Advisors, we are M&A advisors specifically in the short term/vacation rental industry. If you have any questions, please reach out.

Contact Us!